Money lessons are learnt at home just like other crucial life skills such as love for nature, eating a balanced meal, growing your own plants, learning about your body, and so on.

These skills are picked up by children based on observation and behaviors they observe early on in their lives. It is show rather than tell and even though many of us are not aware, there is so many cues they pick up as they grow up.

Several research reports on developing financial capability have shown that there are three factors that drive financial behavior,

- Knowledge of financial products and concepts about money.

- Financial inclusion, engagement and access to money and these financial products.

- Values and attitude towards money such as saving, borrowing, spending, investing, understanding your financial position, and so on

Ability or knowledge of financial products and concepts is not a driver of behavior with respect to two key capabilities - day-to-day money management and active saving behavior.

This means, when it comes to managing your money, access to money and your attitude towards money has a say in your behavior.

Money mindset is picked up early on in your life. It is influenced a lot by how your parents handle money and money decisions. For eg: were they anxious when money runs short. They feel their money situation never improves, or were wary of borrowing, nonchalant about borrowing implicitly impart attitudes towards money.

If you are self-aware and independent, you will either unconsciously follow their footsteps or consciously stray away from what they would do.

And this depends on what you value and who you are as a person? And for sure you will evolve over time.

Teenagers and young adults are digital natives and hence they do have access to smart phones that are now used for day-to-day transactions, for example: whether it is booking a cab, ordering food, or buying clothes or gadgets.

Therefore, parents have to involve them in money conversations and decision making such as healthy meal choices, being mindful about what they buy and consume whether it is clothes, food, electronics, or gifts. Engaging family conversations involving your teenager will help immensely in this aspect.

One tool that can be introduced early on is to track their expenses and income. As simple as it sounds, it has a profound impact on inculcating healthy money habits in children and adults alike.

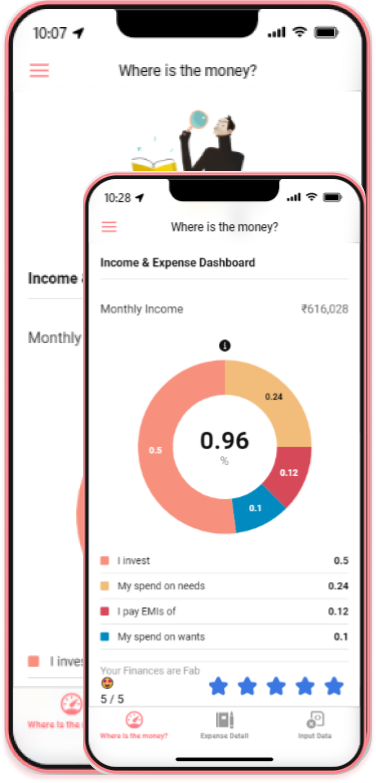

A highly customized and personalized expense tracker that helps you categorize expenses and income, derive insights on your spending and correcting if you are not on track is the need of the hour.

Here is an example of a personalized expense tracker that will help you do just that. It includes an e-book that explains and guides you along as you put it into practice.

To pre-order your copy, please visit here.