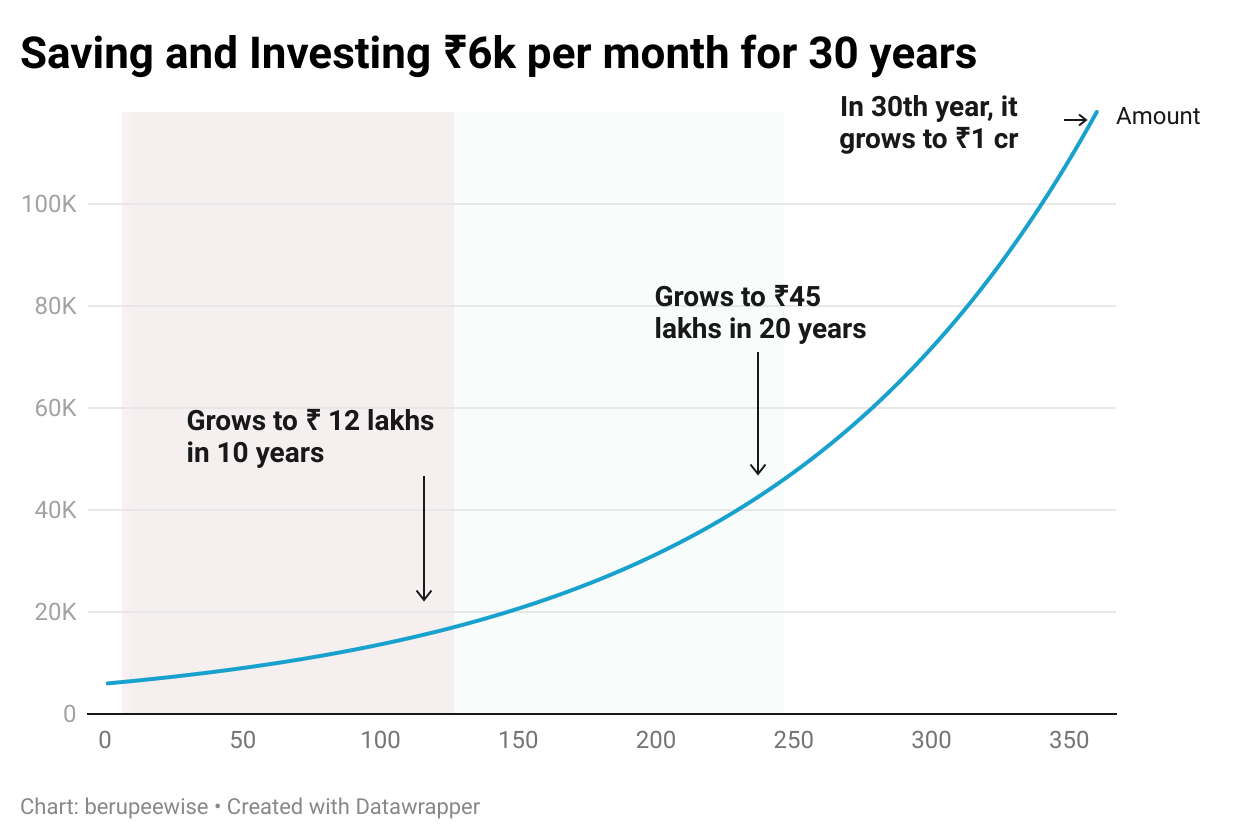

Charts like these that show how much your money grows in 30 years. It makes a classic case for saving money now so that you can reap the benefit in future.

It clearly shows that money when saved and invested regularly grows and compounds over time.

For example: If ₹6000 can grow to ₹1 cr in 30 years, you can imagine what will happen if you were to invest a lot more, say ₹25k or ₹50k?

However, in reality, we don't begin early, we don't stay consistent, we break compounding, we don't track our savings, and we are not able to get a consistent return.

In this example, a return of 10% is assumed. If you reduce that to say 8%, the numbers will change. Its very easy to do this on paper, in reality it makes a huge difference to our corpus.

And, not all of us only care about building a corpus.

There are other things we care about. It could be a vacation, a wedding or an experience you want to enjoy. And, we all know that these things cost a lot of money.

Its one thing to say we work to earn money so that it can be put to use for our big and small decisions. But, are we so conscious of where our money is going?

We are constantly making money decisions. Here is an example:

It says convincing you is a piece of cake :)

When every marketer out there is trying to nudge you to make choices that benefit him, relying on just your willpower will not do the trick.

What do you do then?

And there is enough being written about how emotions take over and influence our choices. And, that is something the marketeer is learning about us.

If you have come so far, I'm assuming you want to know where your money is going?

Again on paper, its very simple to do. Won't take you more than 5 mins.

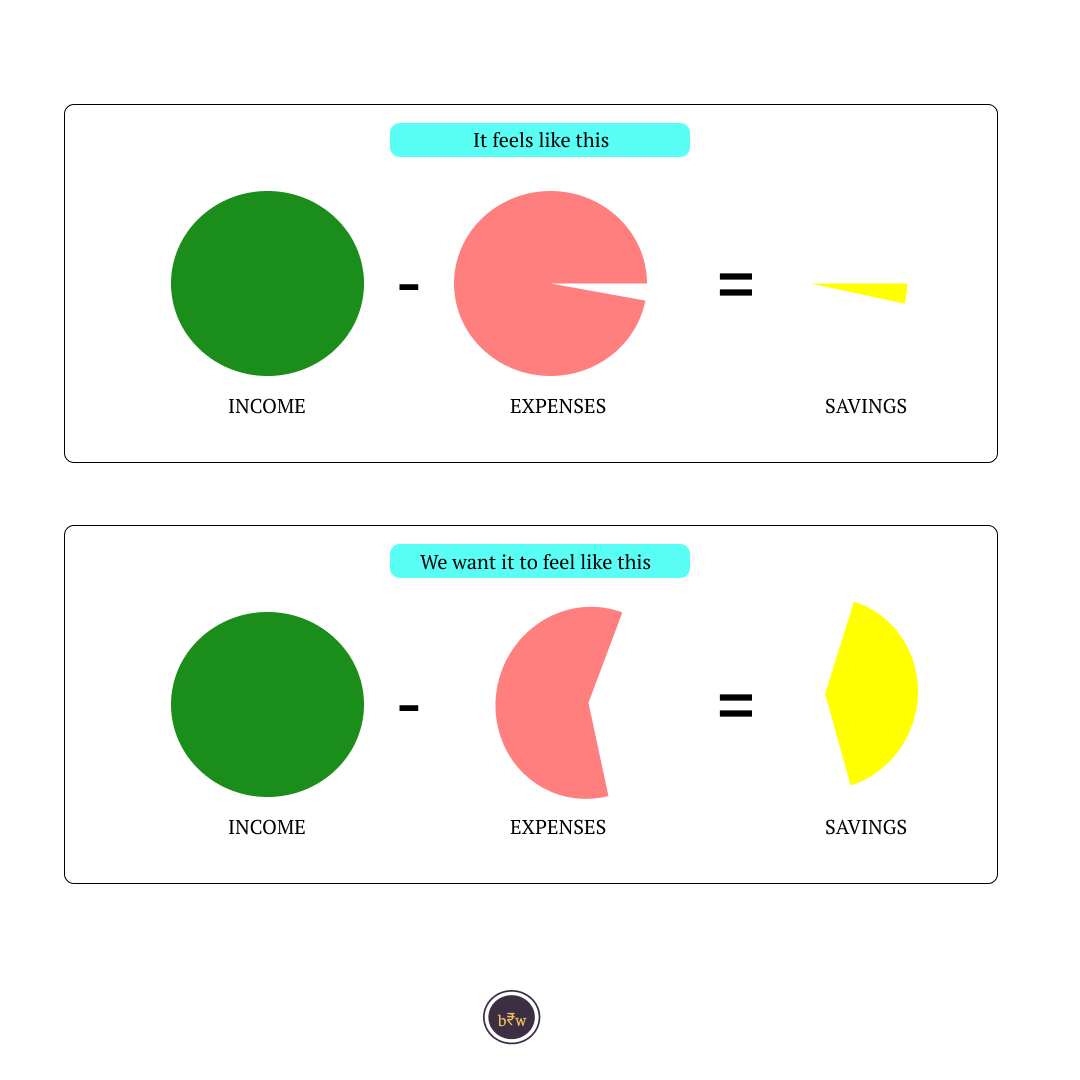

Add your income, subtract your expenses and the balance is your Savings

Income - Expenses = Savings

In reality, it feels like this:

Do you have a fair idea based on mental calculations that you save this much every month? And want to know how much is that much 🤔

And would like to get more insights into your spending where you intend to get better at allocating your money or budgeting.

For those of us who want to find out if we fall in rectangle one or two, here is a simple and easy way to find out.

It will take about 30 or even 60 minutes depending on how many wallets, bank accounts and credit cards you have.

First step is to take a deep breath. And get yourself your favourite beverage. It might help if you can download your bank statements - all savings accounts and credit cards, wallets and purse (literally digital and physical) and see if there is any cash in your wallet.

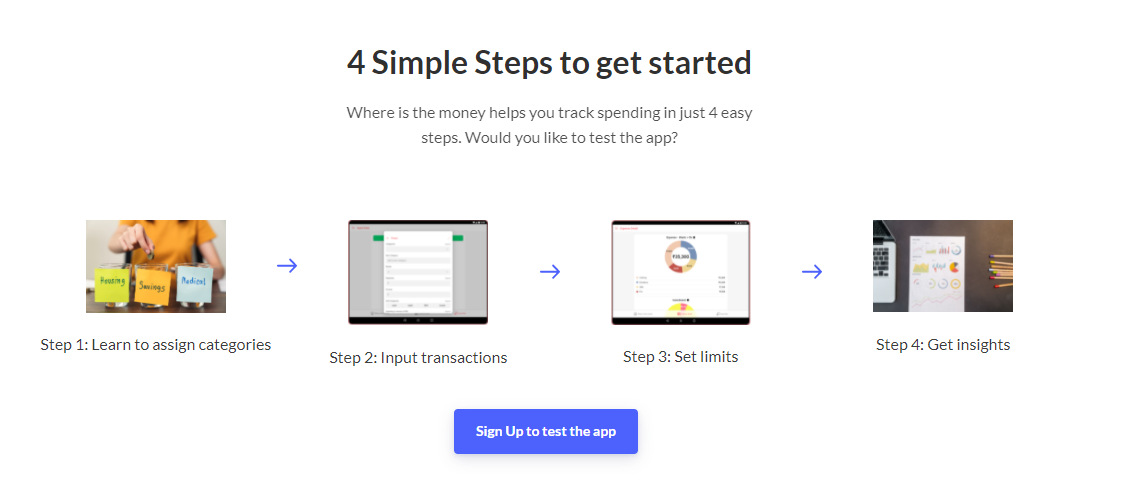

Step 1 - Categorize your expenses. For example - Groceries, Rent, Fuel, Hobbies, Shopping for clothes, Eating out, Taxes, etc

Add subcategories - Depending on how granular you want to get, you can assign sub categories too.

Step 2 - Input transactions

Step 3 - Set limits, if you want to

Step 4 - Get Insights

Download this sample that will help you get started.

Once you know how much you are spending and on what categories, it will help you make changes and increase or decrease your spending across categories.

You only need a tracker. Some people prefer an excel sheet while others prefer pen and paper.

What do you prefer?

This is simple enough and we all know how to do this. If we know how to do this, what gets in the way?

Our ability to do this consistently gets in the way.

As we have multiple things to do in your professional and personal life, this can get quite overwhelming.

Here is one solution that will help you track and not feel overwhelmed as well.

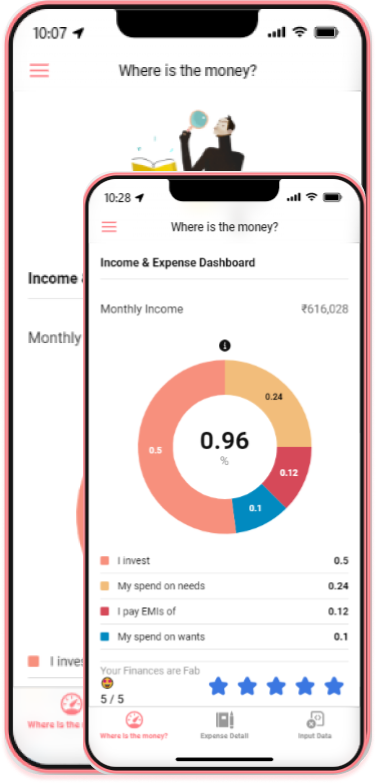

Where is the money app simplifies tracking for you

This is a personal finance tracker that helps you track your expenses on the go and get insights into your spending.

How does it work?

On a 60 min call, we can setup your base app and categories, sub categories and frequency.

The app can be added to your home screen and you can input transactions on the go into it. The app gives you insights that will help you find out where your money is spent and take timely action.

The frequency of entering transactions can be customized. The benefit is you will know your financial status at any time on the go.

Write to me at sreelakshmi@berupeewise.com if you want to get access to this app.