A friend of mine has worked hard and saved some money and will retire in another 10 years. She wants to invest the corpus and get a return on investment that will help her meet her child's education expenses and also build wealth.

There are three ways of approaching this:

- Invest the corpus and whatever return on investment she gets, she can withdraw and pay the child's school fees.

- Invest the corpus and whatever return on investment she gets, she can reinvest so that it helps her build wealth.

- Invest part of the corpus and get returns and the remaining is reinvested.

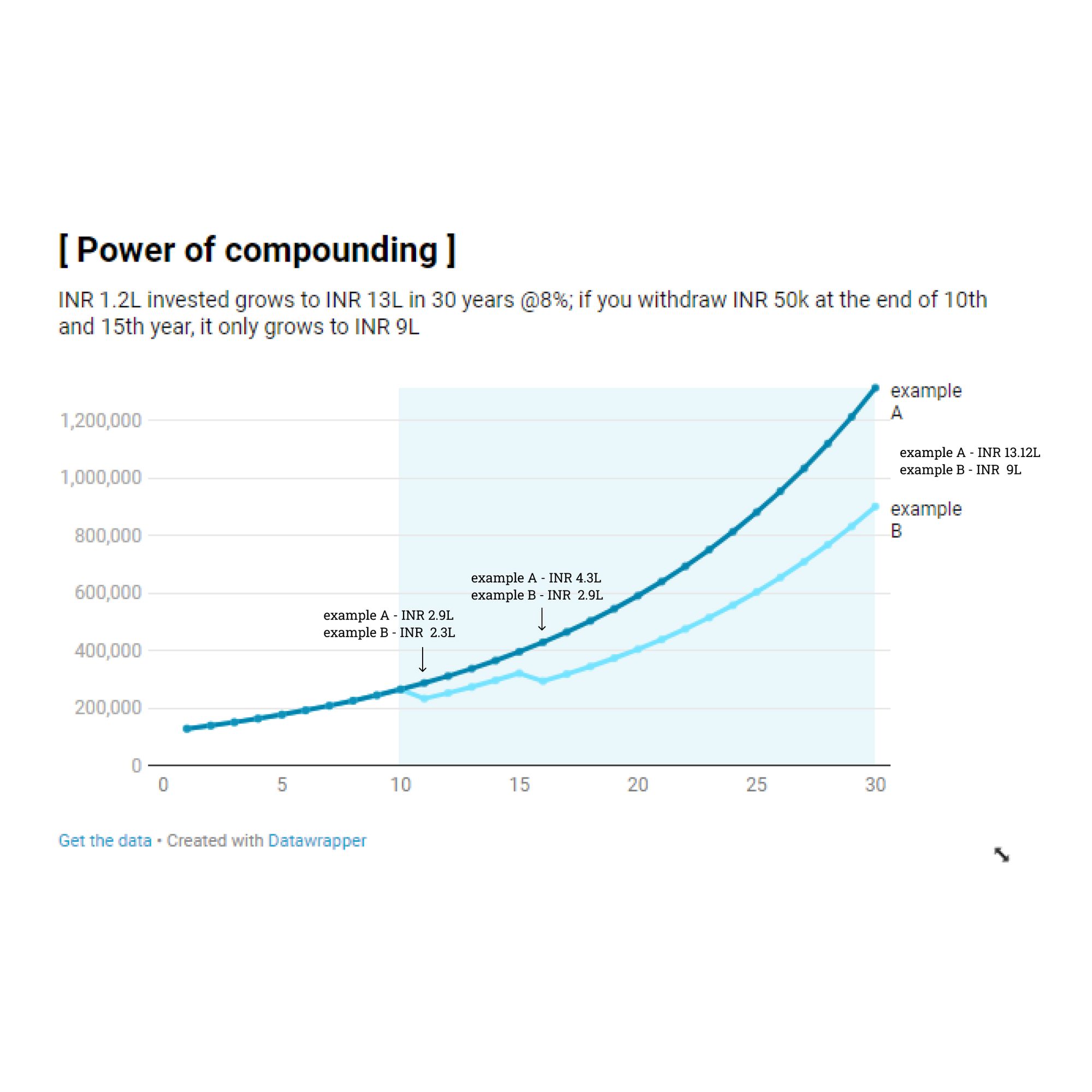

The idea here is if you want to invest and periodically withdraw the return, you are breaking compounding.

The power of compounding works when you have invested your principal or corpus and reinvested the interest or return on that investment for a long time.

Here the time is the main consideration. If you have enough time in hand, you will be able to see your money grow at a compounded rate but if you break compounding and withdraw money, it will not grow as much.

Here are two examples that shows what happens when you break compounding.

Scenario - There is an example that shows why you should start investing early and how this will benefit people begin even if you do not have enough to invest.

Who do you think has excess money at the end of 50 years?

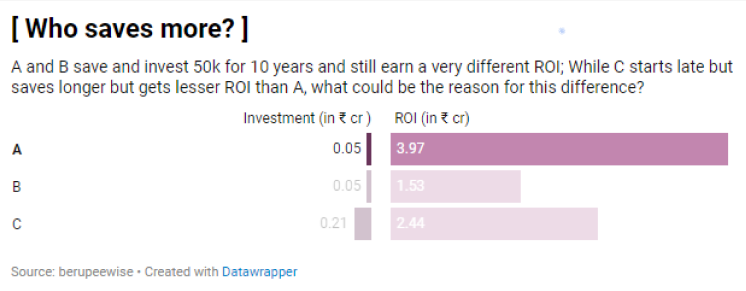

We can clearly see that though A has invested a lot lesser, she has a lot more corpus at the end of 50 years.

Even though C has invested a lot more than A, as she started late (approx. 10 years after A did), the corpus in the end is a lot lesser than A

The Key takeaway is to start investing early and if you have not done that, don't worry.

If you start now and let the money compound, your kids can avail this benefit as they will have time to wait for the money to compound.

And the other main takeaway is to not break compounding.