Understanding your relationship with money is far from easy. Here is an attempt to simplify it for you (underline the word attempt).

As the name suggests, personal finance is highly contextual and personal. There are no universal laws governing personal finance. But a little bit of effort is enough to get you started on your journey of self awareness.

Financial wellbeing is crucial for our overall wellbeing and so we must take care of it.

When we do start looking at our own financial wellbeing we notice certain things that are unique and contextual to us.

Let's therefore start with finding out a little more about ourselves and assess our financial wellbeing

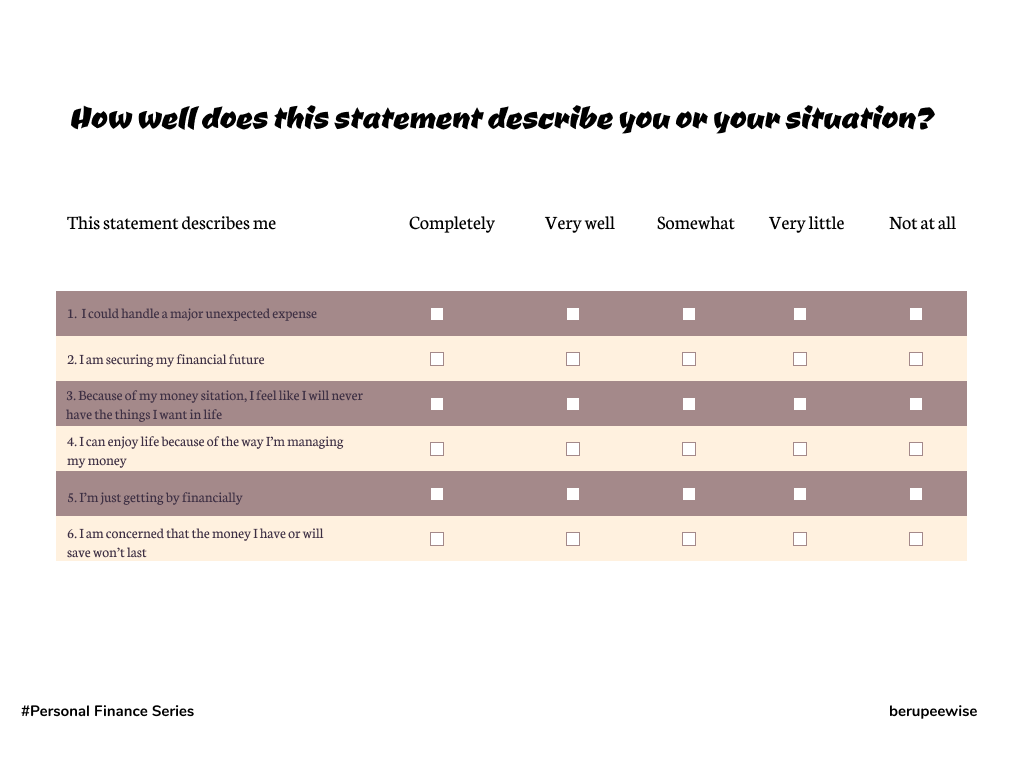

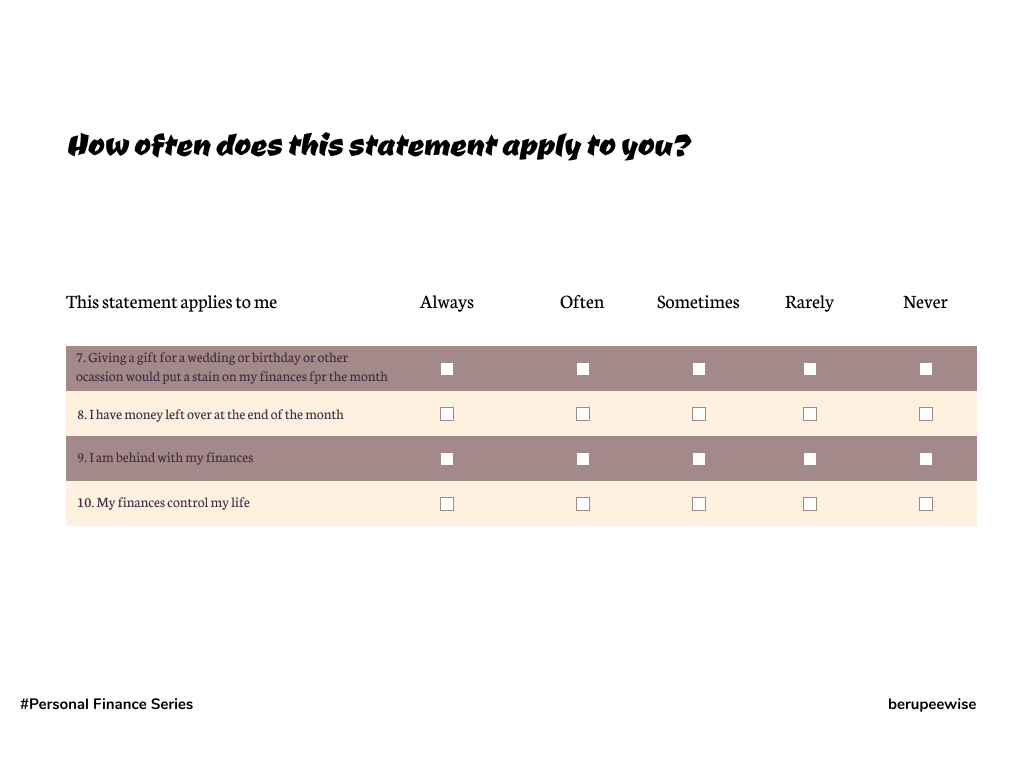

Here are some questions to reflect to find your financial wellbeing score:

After you answer these questions, the next step is to score it.

For Questions 1, 2, 4 and 8 the score is Completely - 4; Very Well - 3; Somewhat - 2; Very little - 1; Not at all - 0

Take a piece of paper and mark your score for questions 1, 2 and 4

For Questions 3, 5, 6, 7, 9 and 10 the score is Completely - 0; Very Well - 1; Somewhat - 2, Very little - 3, Not at all - 4

Mark your score for these questions as well.

The next step is to add your score.

Your financial wellbeing score is the total score after adding all your responses.

What does this mean?

Higher the better, a higher score is preferred. That said, here is your first step towards being financially aware.

Now, take a moment to reflect on this exercise.

How are you feeling now?

Knowing your financial wellbeing score is a good place to start. If you think it is good, you could improve it. If you think it is bad, you can still improve it.

Building Wealth

Building Wealth is an aspiration or goal for many of us. Is building wealth the same as financial wellbeing?

How does it impact your financial wellbeing?

Is building wealth the same as being wealthy?

We are a new generation of people who want to build wealth as we find that as most or atleast some of our basic needs of food, shelter and clothing taken care of, we must move up the Maslow's pyramid where we seek other bigger better things for us.

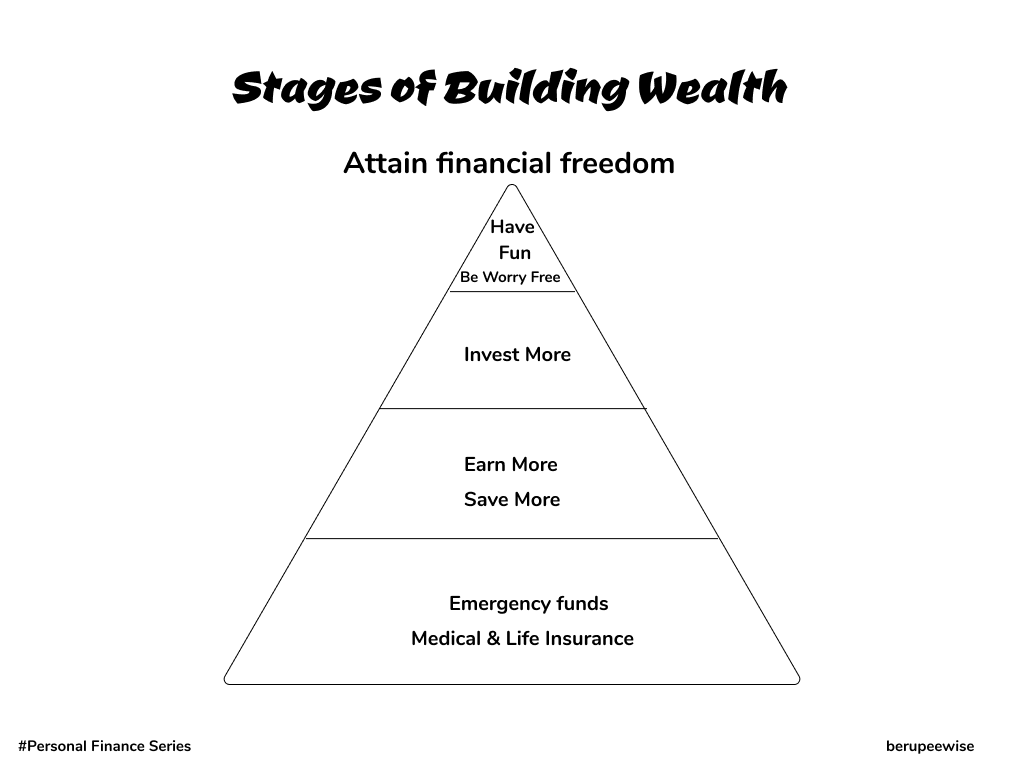

Building wealth is like building a house; we begin with a strong foundation, add pillars and then finally add the roof.

Here is an image or visual to explain this:

Here the foundation is the funds that will take care of our emergency needs and the fact that we are able to earn and save more. It essentially means we need to start building wealth as soon as we start earning.

For all the people who are starting a new job or are early in their careers, this is a big realization and a starting point. As with building a house, it takes time. You cannot build wealth overnight. Therefore, starting early is the key.

The next step to building wealth is not only saving but also investing your savings.

Income - Expenses = Amount Saved

Saving is the first step.

Investing your savings in assets (like Stocks, Mutual Funds, Real Estate etc) generates more income and builds wealth for you.

These are the pillars of your house. The stronger the pillar, the stronger the house.

The roof is what covers your house and these are those things that are needed to ensure that you keep earning well.

I call it Self-care, learning and earning. Investing in continuous learning will help you become a better version of yourself and investing in books, courses, your health and mental wellbeing makes you stronger from inside.

Investing in your hobbies and activities that helps you pause and reflect on what is important for you makes it even better.

This is your roof that will ensure that your house will be protected from all the external impacts like sunshine, rain, thunder, etc.

I'll leave you with a beautiful image of a house that you can also build and we will look at how to do that in the upcoming articles.